city of loveland co sales tax

The Loveland Colorado sales tax rate of 67 applies to the following three zip codes. Businesses located in the Centerra Fee districts sales tax rate is 175 and is in addition to the district fees.

Denver Based Angi Parent Of Homeadvisor Sheds Office Space As It Prepares To Welcome Workers Back Https Dpo St 3j9x0ro Shed Office Office Space Shed

Reserve a Meeting Room at the Public Library.

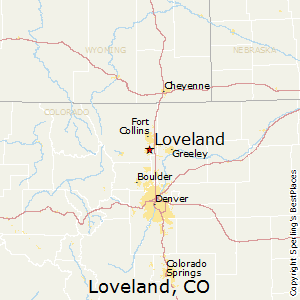

. Loveland is located within Larimer County Colorado. Loveland CO Sales Tax Rate. Utility bill payment assistance COVID-19.

Pay My City Sales Tax. Before you apply for a sales tax license or submit your first payment please contact your bank and provide them with the City of Lovelands ACH DebitAccess ID 8846000609. Did South Dakota v.

The average cumulative sales tax rate in Loveland Colorado is 67. Real property tax on median home. The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670.

Monday May 16 2022 at 1200 PM. Rates include state county and city taxes. This program issues food sales tax rebates to individuals and families who qualify according to HUD income guidelines.

Sales Tax Calculator Sales Tax Table. Colorado CO Sales Tax Rates by City. 6789 plaza drive federal heights co 80260.

Before you apply for a sales tax license or submit your first payment please contact. Sales Tax State Local Sales Tax on Food. This is an opportunity in a small department with varied responsibilities.

The Loveland Colorado sales tax rate of 67 applies to the following three zip codes. Reserve a Meeting Room at the Chilson Center. The Colorado sales tax rate is currently 29.

11th Street Loveland CO City of Loveland 500 E Third Street Utility Billing in front of cashier Loveland CO Loveland Public Library 300 N. The city of Loveland is asking voters to approve a 1 sales and use tax increase excluding food bought for home consumption which would remain taxed at the current rate. This is the total of state county and city sales tax rates.

The latest sales tax rate for Loveland CO. City of Loveland Home Menu. The Loveland Colorado sales tax rate of 67 applies to the following three zip codes.

For more information please visit the PIF RSF Fees page. The salary range for this position is 59600- 92400 per year with a hiring range of 59600 - 76000 depending on qualifications and experience. Position will close to applicants on.

The city of Loveland announced Wednesday that it will further extend the March and April deadlines for businesses to remit sales tax until June 1. Choose Avalara sales tax rate tables by state or look up individual rates by address. 80537 80538 and 80539.

This includes the rates on the state county city and special levels. Always consult your local government tax offices for the latest official city county and state tax rates. The County sales tax rate is 08.

The loveland sales tax rate is. Voters last agreed to. Within Loveland there are around 3 zip codes with the most populous zip code being 80538.

About City of Loveland. 2020 rates included for use while preparing your income tax deduction. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

The minimum combined 2022 sales tax rate for Loveland Colorado is 67. Some financial institutions have a debit block that will not allow ACH debit payments to go through. The Loveland Sales Tax is collected by the merchant on all qualifying sales made within Loveland.

The salary range for this position is 59600- 92400 per year with a hiring range of 59600 - 76000 depending on qualifications and experience. To view Building Permits click Public Access from the choices on the left no login credentials needed For Sales Tax please provide email login and password. Help us make this site better by reporting errors.

Northglenn CO Sales. The sales tax rate does not vary based on zip code. The city of Loveland announced Wednesday that it will further extend the March and April deadlines for businesses to remit sales tax until June 1.

House of Neighborly Service The Life Center 1511 E. The City of Loveland Loveland uses ACH debit for all online payments. 2020 rates included for use while preparing your income tax deduction.

Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. Groceries are exempt from the Loveland and Colorado state sales taxes. Monday May 16 2022 at 1200 PM.

In the 1990s when the City of Loveland became a home rule city collection of all sales and use taxes previously the responsibility of the state were taken over by the City of Loveland. Position will close to applicants on. The salary range for this position is 59600- 92400 per year with a hiring range of 59600 - 76000 depending on qualifications and experience.

Third Street Loveland CO 80537 Phone. The Loveland sales tax rate is 3. The Loveland Colorado sales tax is 655 consisting of 290 Colorado state sales tax and 365 Loveland local sales taxesThe local sales tax consists of a 065 county sales tax and a 300 city sales tax.

What is the sales tax rate in Loveland Colorado. There are approximately 69796 people living in. The latest sales tax rates for cities in Colorado CO state.

City of Loveland - Sales Tax Administration is located at 410 E 5Th St in Loveland CO - Larimer County and is a business listed in the categories City County Government Miscellaneous Government Government Offices City Village Borough Township and Government Offices. Loveland CO Sales Tax Rate. An alternative sales tax rate of 77 applies in the tax region Berthoud which appertains to zip code 80537.

Businesses located in the Centerra Fee districts sales tax rate is 175 and is in addition to the district fees. City of Loveland - Sales Tax Administration is located at 500 E 3rd St in Loveland CO - Larimer County and is a business listed in the categories City County Government and Government Offices City Village Borough Township. The city of lovelands sales tax rate is 30 combined with larimer counties 080 sales tax rate and the state of colorados 29 sales tax rate the overall total is 670.

An alternative sales tax rate of 765 applies in the tax region Windsor which appertains to zip code 80538. The city of lovelands sales tax rate is 30 combined with larimer counties 080 sales tax rate and the state of colorados 29 sales tax rate the overall total is. This rate includes any state county city and local sales taxes.

This is an opportunity in a small department with varied responsibilities. Last month the city announced that penalties for. Start Move or Expand Your Business.

The Loveland Use Tax was created in the late 1990s and imposes a 3 fee on all materials used in. CO Sales Tax Rate. About City of Loveland.

Water Park Resort Hotel Conference Center Planned In East Loveland

My Account Portal City Of Loveland

666 Peggy Ct Loveland Co 80537 Realtor Com

5287 Deer Meadow Ct Loveland Co 80537 Realtor Com

An Architectural Historic Inventory Of The Loveland Hewlett Packard Property City Of Loveland

Closed Request For Expression Of Interest Loveland Colorado Whitewater Adventure Park And Resort Loveland Department Of Economic Development

Loveland Colorado Co 80538 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Foundry Sculpts New Future For Downtown Loveland Colorado Real Estate Journal

Development Center City Of Loveland

2615 Anemonie Dr Loveland Co 80537 Mls 2414950 Redfin

Canyon Springs Homes For Rent Boynton Beach Rentals Florida Rentals Delray Beach Florida Beach Houses For Rent

Lakeshore At Centerra Loveland Co

Loveland Jax Store Could Move Into Former Kmart Location Loveland Reporter Herald

Loveland Colorado Co 80538 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders