how are annuities taxed to beneficiaries

The basis or monetary contribution that purchased the annuity is not taxed. 11 Little-Know Tips You Absolutely Must Know Before Buying An Annuity.

Period Certain Annuity What It Is Benefits And Drawbacks

If its a non-qualified annuity you wont have to pay income.

. Get Personalized Rates from Our Database of Over 40 A Rated Annuity Providers. However the downside of doing so is that for an annuity held outside an IRA the entire amount of the appreciation between. Ad Learn More about How Annuities Work from Fidelity.

Beneficiaries of Period-Certain Life Annuities. How Inherited Annuities Are Taxed. Those amounts are taxable at the ordinary rate and your heirs can choose several ways to manage the resulting tax situation.

Annuities offer enhanced death benefits to allow beneficiaries to offset. If you have a 500000 portfolio get this must-read guide from Fisher Investments. To avoid taxes on an inheritance for your beneficiaries utilize a deferred annuity or a life insurance policy.

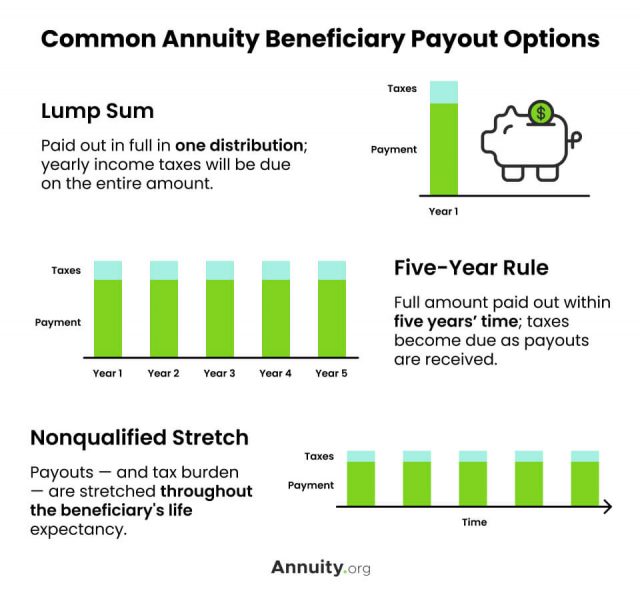

How taxes are paid on an inherited annuity will depend on the payout structure selected and the status of the beneficiary. You definitely need to get the contract and read it. Beneficiaries need not worry about having to pay taxes on their entire.

Inherited annuities are taxable as ordinary income. The taxed amount depends on the payout structure and the beneficiarys relationship with the annuity owner as a surviving spouse or otherwise. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

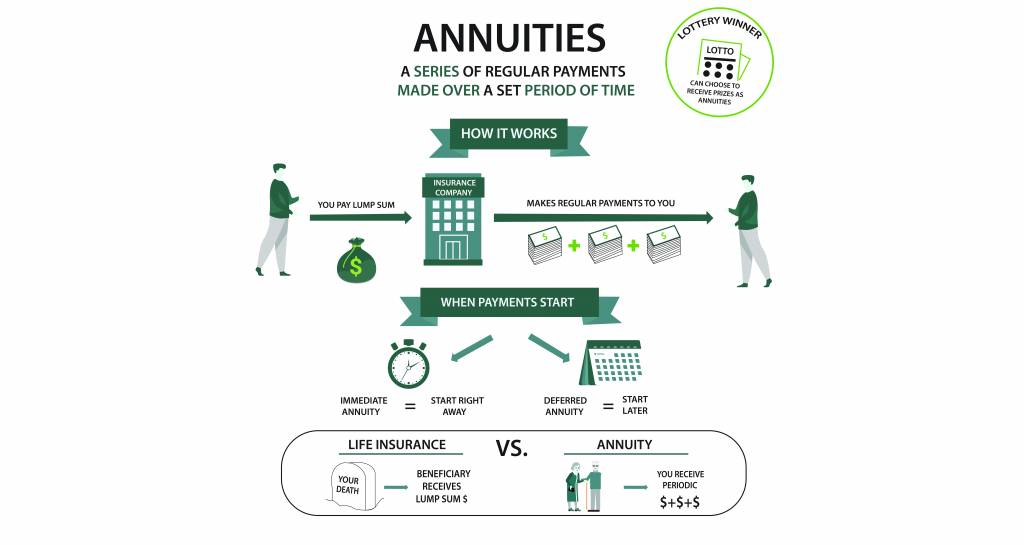

Ad Learn some startling facts about this often complex investment product. Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both. How are annuities taxed when distributed.

If they choose a lump sum beneficiaries must pay owed taxes. With non-qualified annuities funds come from post-tax dollars. The Basics Annuities are based on life insurance and the.

When someone inherits an annuity they owe taxes on the proceeds. This means the money was already taxed before it was put into the annuity. How the beneficiary is taxed depends on whether they receive the annuity in a lump sum or.

Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities. Taxes owed on an inherited annuity will depend on the payout structure and the status of the beneficiary. If a beneficiary chooses to take the money all at once.

Withdrawals and lump sum distributions from an annuity are taxed as ordinary income. Ad Americas 1 Independently Rated Source for Annuities. Inherited Non-Qualified Annuity Taxes.

Dont Even Think About Buying An Annuity Before Reading This. Ad Learn some startling facts about this often complex investment product. If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies.

What this means is taxes are not due until you receive income payments from your annuity. If the beneficiary is entitled to receive a survivor annuity on the death of an employee the beneficiary can exclude part of each annuity payment as a tax-free recovery of. The simplest is to elect an immediate lump sum.

In the case of eligible annuities you will be taxed on the entire withdrawal amount. If you have a 500000 portfolio get this must-read guide from Fisher Investments. For example if the owner.

Nonqualified annuities do not provide a step-up in tax basis to the date of death for the designated beneficiary. Ad Learn More about How Annuities Work from Fidelity.

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Beneficiaries Inherited Annuities Death

Annuity Beneficiaries Inheriting An Annuity After Death

Fidelity Guaranty Life Safe Income Plus Annuity Review Annuity Income Saving For Retirement